On 2 April 2016, Z Traders returned the full amount in cash to Y Merchants. Your responsibilities depend on how the original purchase was made and how you plan on reimbursing the customer. The ABC cosmetics purchase product Y at $40 per piece and product Z at $20. The treatment mentioned above is mainly for the scenario where the purchase had been made on credit. Take self-paced courses to master the fundamentals of finance and connect with like-minded individuals.

Get Your Questions Answered and Book a Free Call if Necessary

- Most returns are handled quickly and efficiently, but some can be problematic.

- Debit The amount owed to the supplier would have been sitting as a credit on the accounts payable account.

- On Feb 2, the journal entry to adjust inventory and record cost of goods sold account.

- This journal entry will decrease both total assets and total liabilities on the balance sheet by $5,000 as a result of the goods returned back to the supplier.

- A decision can then be made about whether to offer a refund, exchange, or store credit.

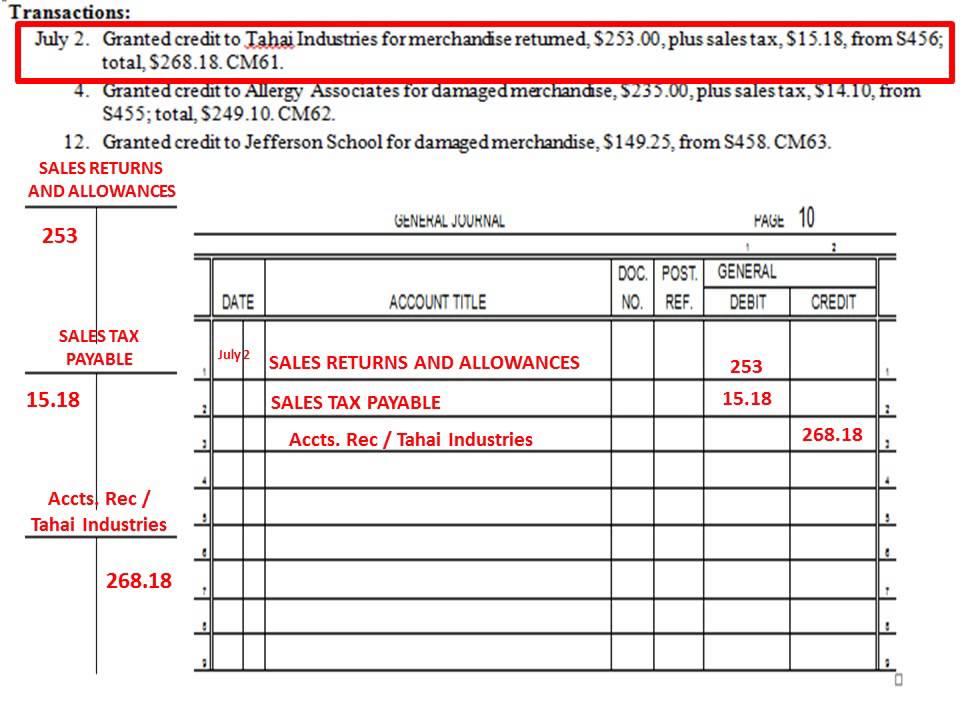

Show the general entries to record sales and sales return in the books of ABC cosmetics. On 2nd Feb 2020, the firm recorded credit sales of 10 pieces for product Y and 15 pieces for product Z to one of its old customers for $50 and $25 each respectively. So when the company’s warehouse physically receives the goods, the inventory account will be debited to increase the asset, and the cost of goods sold will be credited. Purchases A/C’ is not used while recording a purchase return entry. All such events related to returned goods are documented in the final accounts as they have a monetary impact.

How do I set up a sales returns and allowances account?

However, the company still need to make allowance for such transactions in their accounting system. The company allows the customer to return the goods if they are not satisfied. All credit notes received from the supplier are entered in the returns outward book. The entries are listed in more or less the same manner as invoices received are entered in the purchases book. Customers are normally entitled to return the products they purchase from a company when they are not satisfied, usually within a specified duration after the sale. When a sales return occurs, the customer physically returns the product and receives his cash back.

Treatment of Sales Returns in the Financial Statements

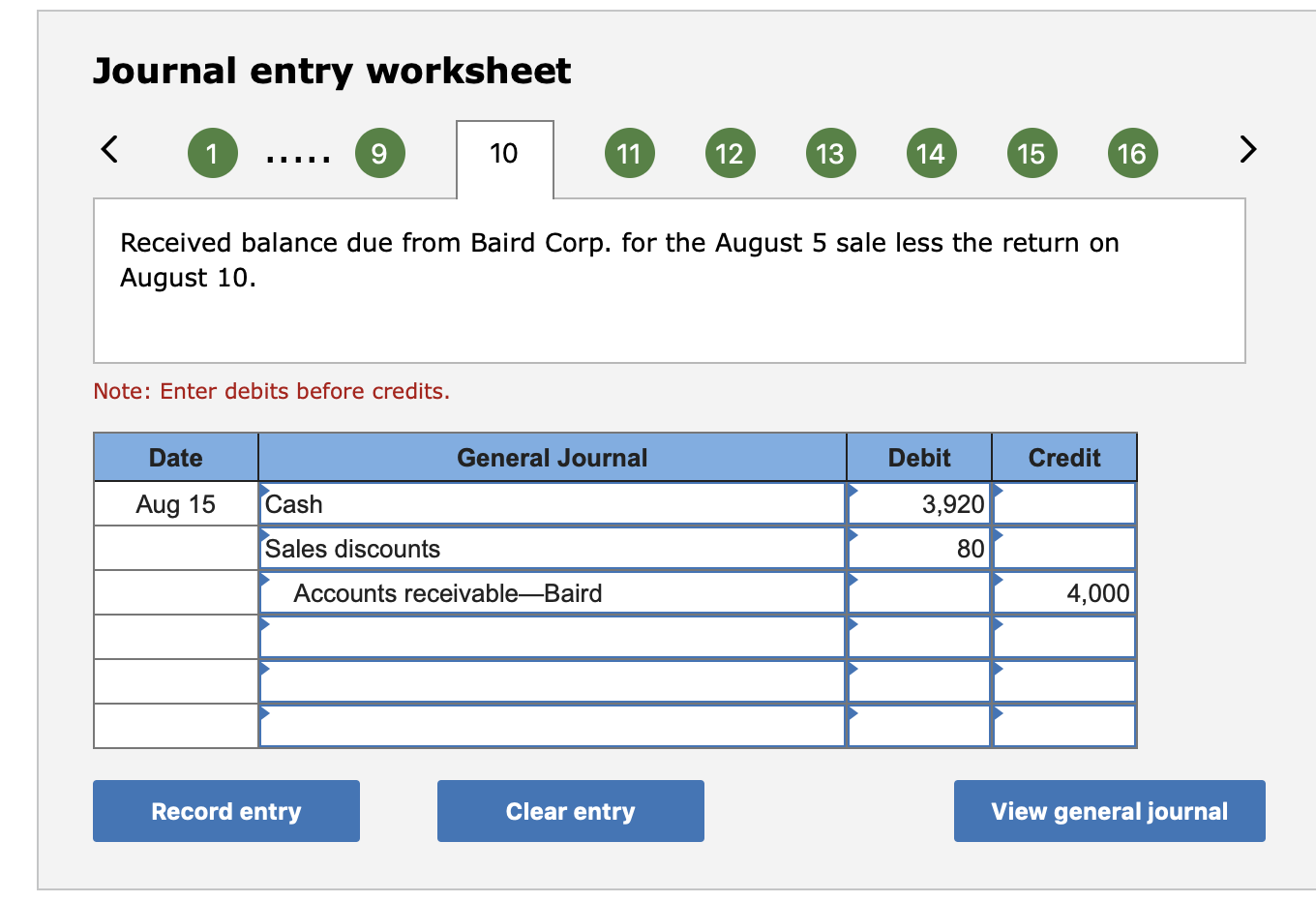

To create a purchase return journal entry, you will first need to identify the merchandise that was returned. Next, you will need to record the credit that was given to you by the vendor or supplier. Finally, you will need to subtract the cost of the returned merchandise from your total sales for the period. Afterward, another journal entry may be required in which the accounts payable account is debited and the cash account is credited. This journal entry is made when a cash refund is given to the customer for the goods they returned. In the first entry, we debit the accounts receivable account and credit the purchase returns and allowances account.

The credit above cancels the amount due and returns the customers balance to zero. A customer makes a sales return by sending goods back to your business. The goods have a sales value of 1,000 and had been sold to the customer on account, the balance due remains outstanding in the accounts receivable (trade debtors) account of the customer. Post an accounting entry for purchase returns in the books of Unreal Corporation. When merchandise purchased for cash are returned to the supplier, it is necessary to make two journal entries.

Either cash sale or credit, we need to reduce cash or account receivable accounts and reduce the revenues. Accounting for sales return is mainly concerned with revising revenue and cost of goods sold previously recorded. journal entries for inventory transactions Account receivable or cash and cash equivalents should also affect whether it is the cash sale or credit sales. When a customer returns something they paid for with credit, your Accounts Receivable account decreases.

No matter how great your products are, you’re bound to have purchase returns at some point or another. Purchase returns reduce the total purchases/accounts payable of a company and the deduction is shown in the trading account. A subsidiary book called Purchase returns book is prepared to record all such entries. Let us understand the advantages of cash or goods purchase return journal entries through the points below.

On 5th Feb 2020, the customer returned 5 pieces of product Y and 6 pieces of product Z to ABC cosmetics. Now we have to deal with inventory/goods that customers just returned. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting.

Leave a Reply