It is thus the book of entry for originally recording such types of transactions for which the organization has no special journal. For additional practice in preparing journal entries, here are some more examples of business transactions along with explanations on how their journal entries are prepared. The Double-entry Bookkeeping is a system of recording transactions that involves recording at least two accounts that will result in a two-sided entry in the journal. This is the opposite of single-entry bookkeeping system which only involves one entry for each transaction. Each transaction a company makes throughout the year is recorded in its accounting system. There are many different journals that are used to track categories of transactions like the sales journal, all company transaction are recorded in the general journal.

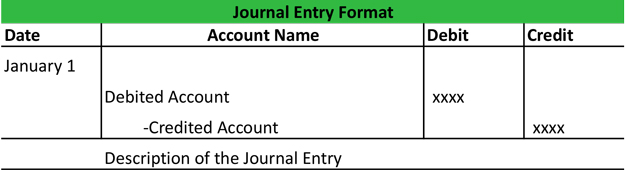

Example of a General Journal Accounting Entry

Business owners and accountants should establish a routine for reviewing journal entries, ideally at the end of each month or accounting period. Modern accounting software simplifies the process of making journal entries. These tools often automate calculations and provide templates for various types of entries. Utilizing accounting software can reduce errors and save time, making it easier for businesses to manage their financial records. A Special Journal is an accounting journal that contains records of high-volume business transactions that are repetitive and of the same nature. The General Journal is the most basic journal and has also the simplest form since it only contains two columns for debits and credits.

Accounting Journal Template

Examples include a sales or purchase return, a compound entry involving several accounts, and most adjusting entries. The general journal will give a chronological record of all non-specialized entries that are otherwise recorded in one of the specific journals. Entries in the general journal play a vital role in the accounting process. By understanding how to record these entries accurately and regularly reviewing them, businesses can maintain their financial integrity and make informed decisions based on reliable data. Debit, which is abbreviated as Dr, refers to the left side of an account. In the example, the cash account was debited by recording the amount of the sale on the account’s left side, resulting to an increase in the balance of the account.

Common Journal Entry Questions

When an accountant book the transactions, and the authorized person approves it, that transaction will directly affect the general journal, general ledgers, trial balance, and general ledgers. To complete an entry in a general journal, one would write a journal entry as usual. One represents the income side and one represents the expenditures side.

These entries are initially used to create ledgers and trial balances. Eventually, they are used to create a full set of financial statements of the company. An accounting journal entry is the written record of a business transaction in a double entry accounting system. Every entry contains an equal debit and credit along with the names of the accounts, description of the transaction, and date of the business event. Since there are so many different types of business transactions, accountants usually categorize them and record them in separate journal to help keep track of business events. For instance, cash was used to purchase this vehicle, so this transaction would most likely be recorded in the cash disbursements journal.

He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own. He has been a manager and an auditor with Deloitte, a big 4 accountancy firm, and holds a degree from Loughborough University. This article discussed a variety of topics related to general journals. You learned what general journals are, how to complete an entry, what they’re used for and more.

Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

In addition to the general journal, there are several special journals or subsidiary journals that are used to help divide and organize business transactions. I also show you how to record the journal entry as well as explain the economic impact of each transaction on the accounting equation. Most of these journal entry examples are also in parts of the accounting course. If you don’t see what you are looking for, use the search bar on the right to find an example. The general journal is part of the accounting bookkeeping system. We call this event a transaction and record it in a speciality journal or in the general journal.

When a general journal is correctly formatted and successfully created, accountants can easily track spending and identify any miscalculations that may exist. The information contained in a general journal can be used to help compile financial statements like income statements, balance sheets, irs says you can amend your taxes electronically, but should you and cash flow statements. Recording a transaction in the books of accounts is known as making an entry. When a transaction is recorded in the journal, it is known as a journal entry. This is why the general ledger is also called the original book of entries, chronological book, or daybook.

- But the record that kind of financial transaction in their own journal.

- Journal entries are the first step in the accounting cycle and are used to record all business transactions and events in the accounting system.

- The information recorded in the journal is used to make postings to the relevant accounts in the general ledger.

- The general journal is an integral part of the accounting cycle and helps ensure that financial statements are accurate and complete.

- Therefore, recording a transaction in the journal is known as a journal entry.

That non-financial transaction included depreciation, adjustments as well as an accrual. Those financial transactions including sales transactions, purchase transactions, cash receipts, cash payments, and many other important financial transactions. One person can specialize on sales journals while another can be responsible for the purchases journal. When using a special journal, only the total amounts of each column in the special journal is posted in the general ledger.

Leave a Reply