The main difference between ARR and IRR is that IRR is a discounted cash flow formula while ARR is a non-discounted cash flow formula. ARR does not include the present value of future cash flows generated by a project. In this regard, ARR does not include the time value of money, where the value of a dollar is worth more today than tomorrow. While that’s certainly true, it’s also unfortunately true that capital investments don’t always lead to great profits.

Do you own a business?

Businesses use ARR to compare multiple projects to determine each endeavor’s expected rate of return or to help decide on an investment or an acquisition. ROI calculator is a kind of investment calculator that enables you to estimate the profit or loss on your investment. Our return on investment calculator can also be used to compare the efficiency of a few investments. Thus, you will find the ROI formula helpful when you are going to make a financial decision. If you know how to calculate ROI, it’s easier to foresee the results of an investment. Along with current income, HPR looks at the capital gains or capital losses of your investment.

How Does Depreciation Affect the Accounting Rate of Return?

For example, you can say ROI when referring to Return on Invested Capital (ROIC), Average Rate of Return, Return on Equity, or Earnings per Share. However, the best known and probably the most commonly used measure is known as simple return of investment, henceforth referred to as return on investment (ROI). It is based on information and assumptions provided by you regarding your goals, expectations and financial situation. The calculations do not infer that the company assumes any fiduciary duties.

Subscribe to the Team Financial Group Newsletter

Concisely put, the Required Rate of Return Calculator is ideal for accurately assessing whether an investment meets the required rate threshold, supporting informed financial decisions in investment planning. Because, it assists investors to decide if a stock or asset meets their return expectations. On the other hand, if the markets are performing well, you can safely increase your withdrawal rate and spend money you didn’t plan to have when you began retirement.

How to calculate rate of return on investment – the rate of return formula

- Learn from instructors who have worked at Morgan Stanley, HSBC, PwC, and Coca-Cola and master accounting, financial analysis, investment banking, financial modeling, and more.

- If we plug our values into the formula, we come up with an ROI of 200%.

- If you would like to find the internal rate of return (IRR) of an investment with irregular cash flows, use our IRR calculator.

- Investments with high volatility have a high degree of risk because their prices are unstable.

- As return on investment (ROI) is sometimes confused with return on equity (ROE), it is worth briefly discussing the similarities and differences between them.

The ARR is the annual percentage return from an investment based on its initial outlay. The required rate of return (RRR), or the hurdle rate, is the minimum return an investor would accept for an investment or project the holiday season that compensates them for a given level of risk. It is calculated using the dividend discount model, which accounts for stock price changes, or the capital asset pricing model, which compares returns to the market.

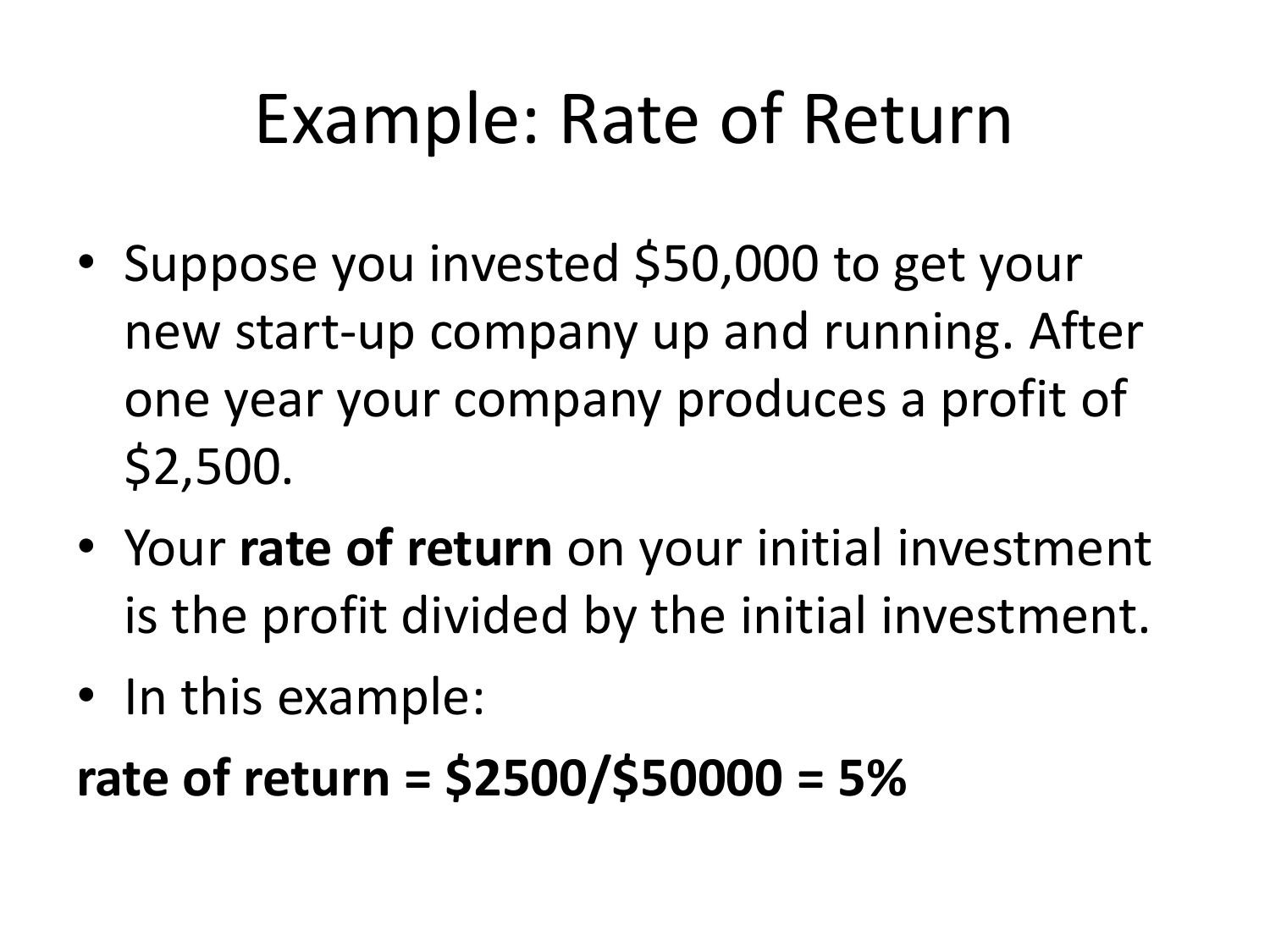

How to Calculate the Rate of Return

If Bob wanted an ROI of 40% and knew his initial cost of investment was $50,000, $70,000 is the gain he must make from the initial investment to realize his desired ROI. Anna owns a produce truck, invested $700 in purchasing the truck, some other initial admin related and insurance expenses of $1500 to get the business going, and has now a day to day expense of $500. Let’s consider hypothetically that her everyday profit is $550 (ideally, it will be based on sales). At the end of 6 months, Anna takes up her accounts and calculates her rate of return. Holding period return also takes into account any cash you periodically receive (such as dividends) from the investment over its holding period.

Investments are assessed based, in part, on past rates of return, which can be compared against assets of the same type to determine which investments are the most attractive. Many investors like to pick a required rate of return before making an investment choice. The accounting rate of return (ARR) is a simple formula that allows investors and managers to determine the profitability of an asset or project.

It’s important that you keep the time periods consistent when comparing investment performance. It incorporates key metrics like the risk-free rate and market risk premium, offering a benchmark return. In business and personal finance, understanding the required rate supports in making informed investment decisions, comparing actual returns with the target rate.

Joe wants to now calculate returns after the 10th year and wants to assess his investment. He wishes to determine which security will promise higher returns after 2 years. Likewise, he wants to decide whether he should hold the other security or liquidate such a position. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. Benchmark comparisons give meaning to your rate of return and help you evaluate whether you’re outperforming on a relative basis.

Some investments may maintain purchasing power over time, but can fluctuate wildly in the short term. For additional practice look at this exercise on the simple rate of return method. You can even gain access to IPO shares, and automated investing strategies, all at a competitive cost, all from the convenience of your phone or laptop. The time value of money is an important concept when it comes to finance, as it explains that money today is always worth more than the same sum of money paid in the future.

Therefore, the rate of return can indicate either the cost of money or the price of money. It works by accounting for factors like the risk-free rate, market premium, and beta. This way, it simplifies calculating the required rate of return, especially valuable for equities or portfolios.

Leave a Reply